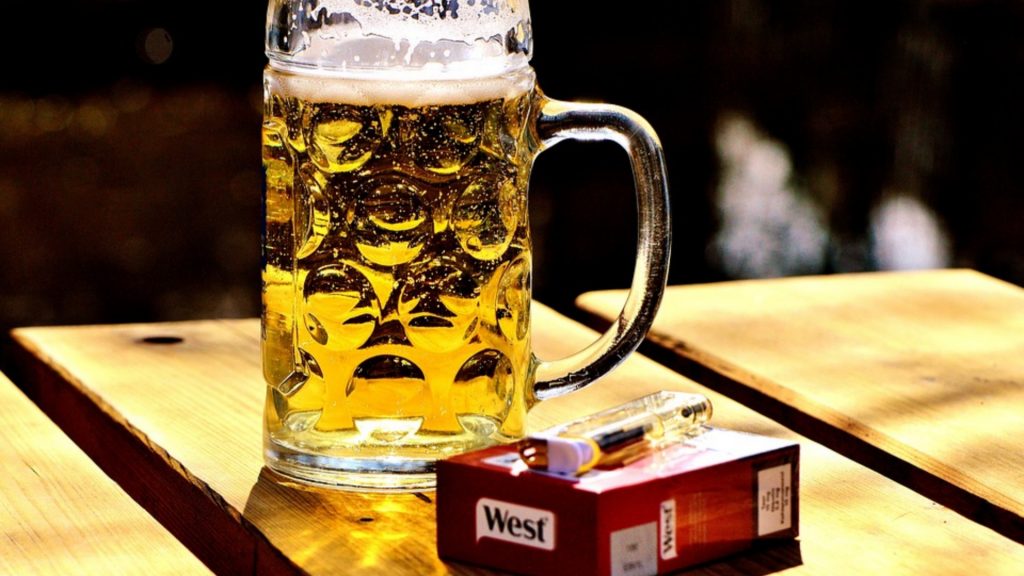

The much-anticipated Budget Speech was delivered in front of the National Treasury, in Cape Town earlier this week by Minister of Finance, Tito Mboweni, who in an effort to raise revenue for the national fiscus has increased excise duties on alcohol and tobacco.

“The targeted excise tax burden for wine, beer and spirits is 11 percent, 23 percent and 36 percent respectively. Since 2002, tax rates on these beverages have increased above inflation each year, alongside above-inflation retail price increases, to maintain taxes at the targeted level. Government proposes to increase excise duties on alcoholic beverages by between 7.4 percent and 9 percent in 2019/2020,” said the Minister during his Budget Speech.

Other increases include:

- A can of beer will have a have an excise duty of R1.74, increased by 12 cents.

- A 750ml bottle of wine will have an excise duty of R3.15, increased by 22 cents.

- A 750ml bottle of sparkling wine increase by 84 cents to R10.16.

- Whisky will increase by R4.54 to R65.84.

- Cigarette packs (20 per pack) increase by R1.14 to R16.66.

- Cigars increase by 64 cents to R7.80.

“Government proposes to increase the excise duties on tobacco products by between 7.4 percent and 9 percent. Cigarette makers appear to have absorbed most of the increases last year rather than increasing prices. As a result the excise burden for cigarettes is likely to remain slightly above target level,” concluded the Minister.